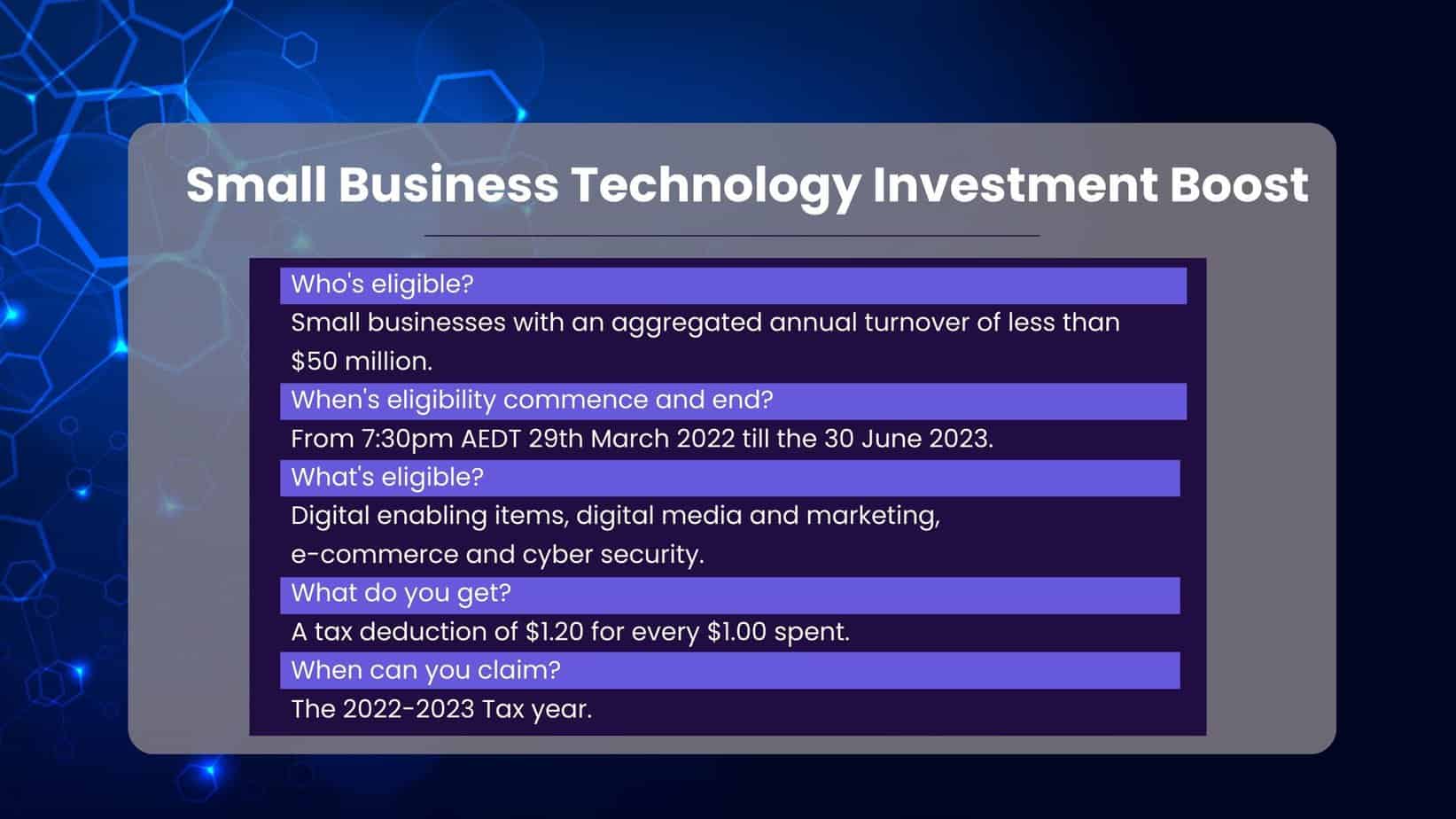

The Small Business Technology Investment Boost has finally made it through the senate a week before the end of the 2022-2023 tax year.

Here is an explanation of the Small Business Technology Investment Boost and how it can benefit your business.

What is the Small Business Technology Investment Boost?

This boost offers a tax deduction for small businesses with an annual turnover of less the $50 million. This tax deduction adds an additional 20% on top of the standard deduction for the cost of expenses supporting the uptake of digital technology. In other words you will be able to claim $1.20 for every $1.00 spent on digital technology for you business.

What does it include?

The boost applies to the following:

- digital enabling items – computer and telecommunications hardware and equipment, software, internet costs, systems and services that form and facilitate the use of computer networks

- digital media and marketing – audio and visual content that can be created, accessed, stored or viewed on digital devices, including web page design

- e-commerce – goods or services supporting digitally ordered or platform-enabled online transactions, portable payment devices, digital inventory management, subscriptions to cloud-based services, and advice on digital operations or digitising operations, such as advice about digital tools to support business continuity and growth

- cyber security – cyber security systems, backup management and monitoring services.

When did it start?

The boost applies to expenditure incurred from 7.30PM AEST on 29/03/2022 until 30/06/2023.

How does it work

For eligible expenditure that was incurred between 7:30 pm AEDT 29 March 2022 until 30 June 2022 you can:

- claim the expenditure as usual in your 2021–22 tax return, and then

- claim the additional 20% bonus deduction for this period in your 2022–23 tax return.

For eligible expenditure incurred from 1 July 2022 until 30 June 2023:

- you can deduct the entire 120% in your 2022–23 tax return.

What else do I need to know about the Small Business Technology Investment Boost

- Expenditure up to $100,000 is eligible for the bonus deduction, with the bonus deduction capped at $20,000 per year. The maximum bonus deduction a business can claim is $40,000 for the entire period.

How can we help you with the Boost?

Encompass Marketing offers web design and hosting as well as other digital marketing activities that are covered under the boost?

To find out what we can do for you in the digital space, please contact us.

Keep In Touch