Answers to your questions about the $150,000 instant asset write-off.

What is the meaning of the instant asset write-off?

As defined by the Australian Tax Office (ATO), the instant asset write-off is where eligible businesses can claim an immediate deduction for the business portion of the cost of an asset in the year the asset is first used, or installed ready for use.

What are examples of assets you can write-off?

Some examples of assets that would be eligible for immediate write-off would be

- Office equipment such as printers, computers, laptops, monitors, fridge, phone or point of sale systems.

- Machinery used for business such as fork lifts, trucks, tractors, harvesters, vans.

- Cars (limits apply – See the ATO for more details).

- Tools such as drills, ladders, tool boxes.

What it is now?

- The $150,000 instant asset write-off has now been extended to June 2022.

- The threshold for a single asset has been removed and is now $150,000. This applies to all assets purchased and installed after 6th October 2020.

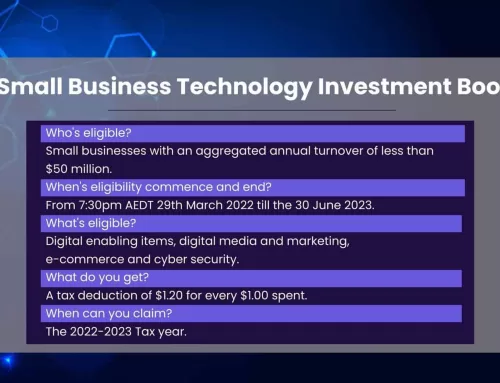

- Eligibility has remained the same and applies to businesses with an aggregated turnover of less than $500 million.

- This instant asset write-off will also apply to all secondhand assets for businesses with an aggregated turnover of less than $50 million.

What it was previously?

- From 12 March 2020 the instant asset write-off increased from $30,000 to $150,000.

- The threshold for a single asset was $30,000 meaning the asset you write-off off cannot be worth more than $30,000.

- Originally this amount was available until 31 December 2020.

- Businesses with an aggregate turnover of $500 million were eligible to claim this right off.

Just one of the measures to assist businesses that has been announced in last weeks budget.

Stay tune for more!

Keep In Touch