A slight detour from marketing, but another passion of mine is financial literacy.

It may seem unusual to some, but economics was my favourite subject in school. It shaped my tertiary education path and sparked my journey into marketing.

I was in high school during the Hawke-Keating era, a thrilling time in Australian economic management and education. With terms like Banana Republics, “J” curves and Keynesian theories being thrown around, along with high interest rates causing an economic recession, it was a truly captivating time to commence my journey into commerce, finance, and economics.

This fascination with all things financial helped me learn at a fairly young age about finance. I was lucky enough to have a natural interest, which made it easy for me to become financially literate. However, not everyone shares my passion for economics and finance, making it challenging for them to learn about income streams, wealth building, crypto currencies, ETF’s, budgeting, and emergency funds.

Love it or hate it, financial literacy is a necessity to anyone who wants to try and achieve a secure and stress free future. So how about we take a look at what it really means.

What is financial literacy and why is it important?

Financial literacy is the ability to understand financial concepts and make informed decisions about your finances. Without it you may struggle with debt, overspending, or inadequate savings. You may also fall prey to financial scams or make poor investment decisions that lead to losses. By contrast, those with financial literacy can take control of their finances, achieve their financial goals, and build a solid foundation for their future financial security.

In todays complex financial landscape where there are so many different investment choices and challenges. What you choose can have a profound affect on the rest of your life.

Why is financial literacy important for women?

Financial literacy is especially important for women because they:

- often earn less than men,

- are more likely to take time out of the workforce to care for children or other family members and,

- are more likely to live longer and have more complex financial needs in retirement.

As a result they are more likely to struggle financially in old age and retire with just over half the amount of superannuation as men.

The power of financial literacy for women is that it;

- empowers them to make informed decisions about their finances,

- helps them create sustainable budgets,

- allows for better money management,

- can help them feel more confident about themselves and their worth, enhance their pay negotiation skills,

- will assist them achieving their financial goals.

Some studies have shown that women are often less financially literate than men. This puts them at a disadvantage when it comes to managing their finances and securing their financial future.

So how can women gain the skills and knowledge they need to manage their finances effectively? How do they make informed decisions about their financial future, and achieve their financial goals?

How can women improve their financial literacy in Australia?

There are a number fo ways for women in Australia to improve their financial literacy, including:

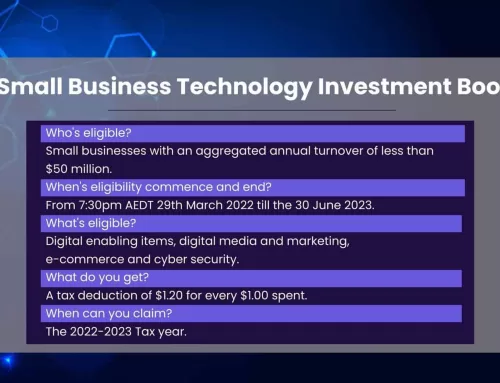

Take advantage of government initiatives and incentives:

The Australian government and each state government offer a range of initiatives to promote financial literacy. This includes the MoneySmart program, which provides information and resources on a range of financial topics, including budgeting, saving, and investing. This program is available for free and is designed to help people of all ages and backgrounds improve their financial literacy and make informed financial decisions. You can also look into government programs such as the First Home Owner Grant, Low Income Superannuation Tax Offset, and others that can help you save and invest.

Participate in community organisations:

There are a number of community organisations in Australia that offer financial literacy programs and services. Including financial counseling and education services, which are often available free of charge. Some examples are:

- moneysmart – helps Australians take control of their money with free tools, tips and guidance,

- Money Minded – a flexible adult financial education program that builds knowledge, confidence and skills to help people make informed decisions and manage their money.

- National Financial Capability Strategy – informs and drives actions to improve the financial capability of Australians,

- The Good Shepherd – tackles the significant issues impacting women, girls and families.

Utilise online resources:

There is a wealth of information and resources available online. This includes websites, blogs, and forums, which can help women learn about financial literacy and gain the skills they need to manage their finances effectively. It might be best to start with government funded resources first as they should be reliable and provide free advise to start you on your journey.

Read books and take courses:

There are a range of books and courses available on financial literacy and personal finance. This can be a great way for women to gain a deeper understanding of these topics and develop the skills they need to manage their finances effectively. Pop on down to your local bookstore and ask them what they have to help your financial literacy. They will be able to guide you and tell you what is popular and you will be supporting a local business. Win-win.

Seek professional advice:

Working with a financial advisor or financial planner can be a great way for women to get personalised advice and guidance on managing their finances. Additionally, they can learn about financial literacy in a structured and supportive environment.

Start budgeting

Keep track of your income and expenses, and make a plan for saving and spending. There are lots of apps to help you. Here is a list from Canstar to get you started.

Build an emergency fund

Aim to have 3 to 6 months’ worth of living expenses saved in a high-yield savings account.

Make the most of your superannuation

Consider consolidating your superannuation accounts and ensuring you’re getting the best possible returns. You can view your super accounts, and transfer your super through your ATO app. Alternatively, if you have linked the ATO through your MyGov app, you can access your super information there as well.

Manage debt wisely

Avoid taking on unnecessary debt and prioritise paying off high-interest debt first. Do some research to make sure you know what a reasonable interest rate is for loans and consider different sourcing channels. There are many options to choose from including banks and credit unions, crowd funding and companies that specialise in short term lending facilities. Just make sure to read the fine print to know exactly what you are getting into.

Diversify your investments

Spread your investments across different asset classes to reduce risk. Asset classes include stocks, bonds, cash equivalents or money market vehicles, real estate and commodities. As well as alternative investments like cryptocurrency, crowd funding, hedge funds, private equity, and venture capital. If you are limited for funds, an easy way to diversify is through the stock market. You can buy index funds for hundreds of different indexes and industries. Exchange Traded Funds (ETF’s) can provide you with a relatively low risk option to invest in all the asset classes.

Please keep in mind that most investment strategies will contain a certain level of risk. Some more than others. A financial planner can help you evaluate what level of risk you can manage based on your personal circumstances. They will also provide you with investment options. Again, I cannot stress enough that, even if you have a financial planner to do most of the work, research is still an essential part of any investment strategy.

Plan for the future

Start saving for your long-term financial goals, such as retirement, and review your plans regularly. There are financial incentives provided by the Australian Government and the Australian Taxation Office that can help women with their super balances. These include the Low Income Superannuation Tax Offset, and the Super co-contribution scheme.

Make sure you are adequately covered for insurance, especially if you have a family and a mortgage. This can be done through your superannuation fund or separately through a life insurance company. Alternatively you can talk to a financial planner and they can tell you what insurance you need and where you can get it.

Stay informed

Read financial news, attend workshops, and educate yourself on the latest financial trends and best practices.

And last but by no means least –

Invest in yourself

Women are notoriously good (or bad – depending on how you look at it) at under-selling themselves. We often lack the confidence to go for those roles that are just beyond our experience or comfort level. If we break down the role bit by bit we could probably do it with our eyes closed but unfortunately lack the courage to take that next step up. If that’s you, consider getting some training or qualifications that will increase your confidence as well as your earning potential. And remember fake it till you make it! by adopting confident body language and behavior, even if you don’t feel confident initially, you can eventually become confident and achieve your goals.

What are some Australian government grants and NSW government grants for women in business?

- The State and Federal government have a number of grants and funding for women in business. Here are links to the Federal Government grants designed specifically for women, and the NSW Government grants an funding page.

- You can also find support and funding through the NSW Government Support for women in business page.

- Women NSW is responsible for improving the lives of all women in NSW by achieving equality through policy, innovation and collaboration. It contains support and information on grants and funding for women is NSW.

- Women in Business program is a NSW Government and TAFE NSW initiative that offers a fully subsidised online program for women who are looking to establish a micro business, a small business, or who are already operating a business.

- The Return to Work Program is for women who have been unemployed for one month or more and intend to return to work as an employee within 6 months.

- Business Connect provides tailored advice, support, and mentoring to small businesses, including those owned by women.

- Future Female Entrepreneurs Program (FFEP) is an innovative entrepreneurship program, available free to all young women in Australia aged 10 – 24. It seeks to build an industry alliance of Australia’s digital leaders, education professionals, entrepreneurial organisations, large and small businesses to ensure Australia’s next generation of businesswomen have the skills to run their own businesses or transform the industries in which they work.

- The Accelerator for Enterprising Women is designed to support and empower Australian women aged 18+ to create self-made career paths, pursue entrepreneurship as a viable career choice and to ensure Australian businesswomen have the skills required to run their own businesses and transform the industries in which they work.

- The Kickstarter Challenge helps women create self-made career paths, pursue entrepreneurship as a career choice and master the skills required to run their own businesses.

- Innovation Connect provides up to $250,000 in funding to help businesses develop innovative ideas and products. Women-owned businesses can apply for funding to support research and development, commercialization, and other innovation-related activities.

It’s important to note that these programs and grants may have specific eligibility criteria and requirements, and availability may vary over time. To learn more about current opportunities, it’s best to check the websites of the relevant government departments and agencies.

Financial literacy is a critical skill for women in Australia, and by improving their financial literacy, women can gain the skills and knowledge they need to manage their finances effectively, make informed decisions about their financial future, and achieve their financial goals. By taking advantage of government initiatives, participating in community organisations, utilising online resources, reading books, taking courses, and seeking professional advice, women in Australia can empower themselves to take control of their finances and secure their financial future.

Keep In Touch